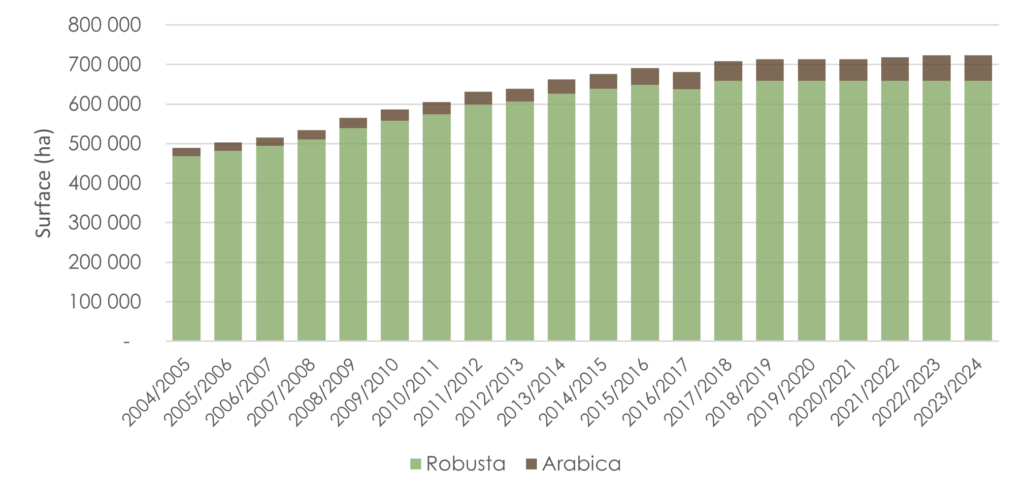

ROBUSTA FARMING IN VIETNAM UNDER PRESSURE?

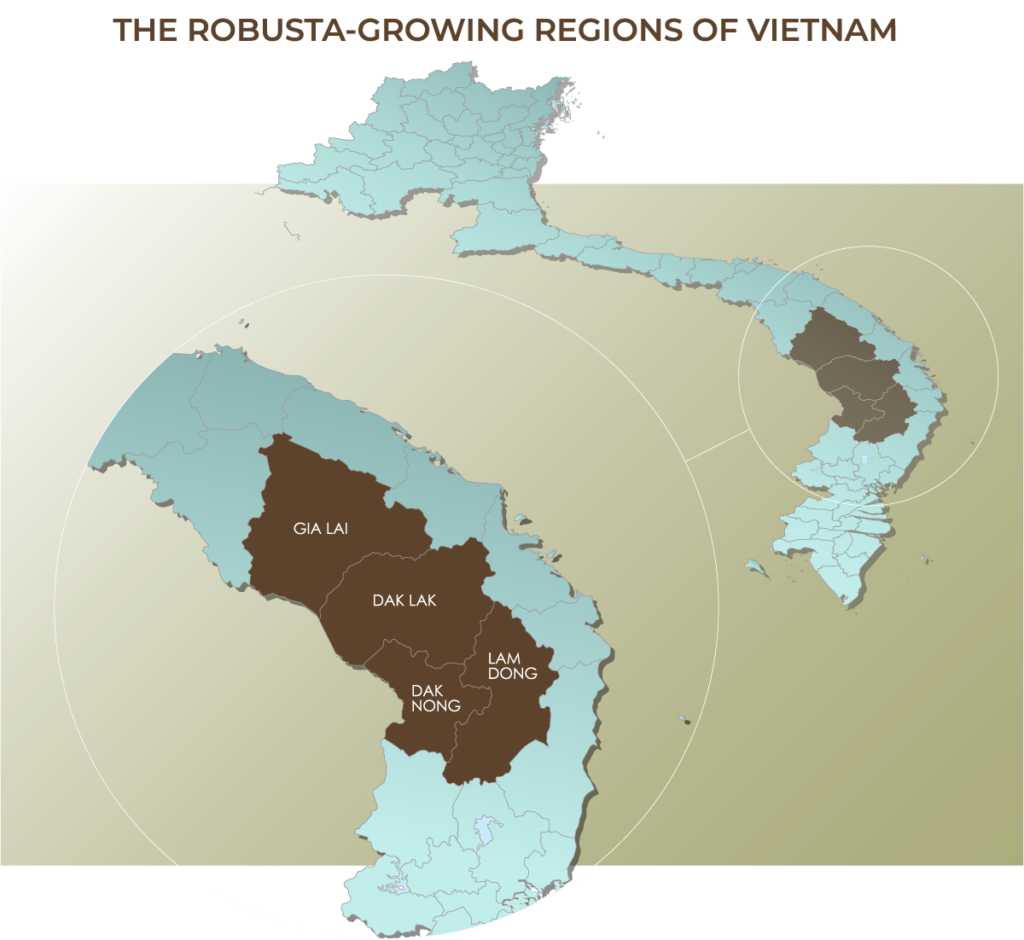

Robusta has historically been a resilient, productive, and stable coffee variety, popular with consumers because of its strong taste, aroma, and favourable prices. It is predominantly grown in the highlands of Vietnam, Brazil, Indonesia, Uganda, and India. However, despite its strong position in Robusta culture, Vietnam must deal with a recent decrease in production, while its Arabica production is expected to remain stable. The 2022/23 Robusta production is about 27,900,000 bags, while the 2023/24 is estimated to slightly decrease, as shown in the chart below.

WALTER MATTER IN VIETNAM

Walter Matter opened its first foreign office in Ho Chi Minh City in 2002, to establish a stronger presence in Vietnam. The Office helps the company to meet the growing demand for Robusta and to maintain a high-quality service to its clients.

We have talked with Tuan Thai Doan, Walter Matter’s Vietnam Office Manager, and Pablo Rapun, Walter Matter’s Coffee Trader in Geneva Office, who travelled to Vietnam at the beginning of December 2023. According to them, it is reasonable to link the current situation of Robusta high prices to two main factors: a stagnation or small decrease of production having to meet an increasing demand for Robusta. Intercropping practices and some minors weather effects contribute to put pressure in the Robusta supply which represents approximately 90% of the coffee delivery in Vietnam.

CROP 2023/24 PRODUCTION – COFFEE TREES GROWTH & WEATHER

From March to May the trees need a substantial amount of water and intensive cultivation – a combination of water, chemical and organic fertilisers.

“Fertilisers are necessary at every stage of coffee farming to mitigate the effects of weather. The farmers are excellent at turning their own agricultural waste into fertilisers, using everything from old cherries through to cut branches”, Tuan said.

From October to November the trees need a dry weather to properly ripen, before the harvest stage during the dry season from December to January.

Then, as temperatures drop and February brings light rain, the green coffee travels to the warehouses while farmers begin to prepare for the next season by trimming trees, cleaning the ground, and fertilising.

Unfortunately, the past weeks from October to mid-November have been relatively wet. The crop was slightly delayed since the cherries were not mature enough to be cropped and to get a proper drying. Furthermore, some provinces reported being impacted by strong winds affecting the plantations. Thus, the timely arrival of expected sunny weather is crucial for the final maturation of the cherries and proper drying. Luckily, the use of fertilizers and the farm care help to positively maintain yields.

“By investing in the rejuvenation of their trees, farmers can repair a lot of the damage caused by poor weather” Tuan said.

“Farmers have invested more in fertilisers and irrigation, aiding recovery of the last crop and enabling better productivity overall” he added.

INTERCROPPING – AN AGRICULTURAL PRACTICE AFFECTING ROBUSTA SUPPLY?

In the highlands, many provinces are opting for intercropping, which allows farmers to diversify their sources of revenues, decreasing their dependency to coffee. It involves planting several trees alternately, with some providing shade to others, thereby reducing their water needs and mitigate climate change side effects. Therefore, it brings benefits from both economic and agricultural perspectives.

More specifically, farmers started to replace their traditional shading trees with durian trees to meet an increasing demand, mainly from China and India. The exports of the “King of Fruits” to these countries are currently at a record level of volumes and prices. The planted area is estimated to be around 70.000 ha, or approximately 10% of the coffee planted area.

Although the practice is beneficial to the farmers, we must consider that such a shift mechanically leads to a reduction of coffee trees density in stagnating plantation areas for few years, and consequently impacting the total production of coffee.

At the same time, Durian cultivation creates a new risky dependency for farmers, as the consumption is concentrated on the 2 major Chinese and Indian markets. That is why Vietnamese authorities are closely monitoring the developments of the Durian culture to prevent any issue, especially given the past experience of rapid expansion in pepper cultivation, leading to subsequent market crashes.

Therefore, we can argue that Durian will never replace coffee culture, but it clearly disturbs uptrend production of coffee in Vietnam since many years.

SUPPLY, DEMAND AND LOCAL PRICES

There is a shift in coffee consumption from arabica to robusta which is contributing to a notable increase in the demand for robusta coffee from Vietnam. During the previous crop season (2022/23), the substantial demand for robusta from local roasters, the soluble industry, and foreign buyers and merchants exerted upward pressure on local prices, reaching historical levels.

The current crop faces the challenge of a diminished supply due to the absence of carryover stocks from the previous season, compounded by continuous high demand. This strain on the market is palpable in the year-on-year escalation of domestic prices for Robusta FAQ. In November 2022, prices were approximately USD 1,870/MT, escalating to around USD 2,480/MT in November 2023, and presently, the market reflects trading figures exceeding USD 2,600/MT.

This trend underscores the tightness in supply and the resultant impact on pricing dynamics in the robusta coffee market.

As of the end of November, farmers are maintaining a slow but steady selling pace. However, it is anticipated that the flow of coffee will increase in the upcoming weeks, primarily propelled by the attractiveness of high local prices. Considering this, it is advisable to closely monitor logistics, as a potential surge in demand for shipping may lead to constraints in the availability of containers or space in vessels.

In summary, the confluence of various factors, including robust internal and external demand for Robusta, minor weather-related challenges, the absence of carry-over, and agricultural practices like intercropping, has exerted pressure on the supply of Vietnamese Robusta.

RECENT NEWS